Recommendation Tips About How To Appeal Your Property Taxes

Ad get access to the largest online library of legal forms for any state.

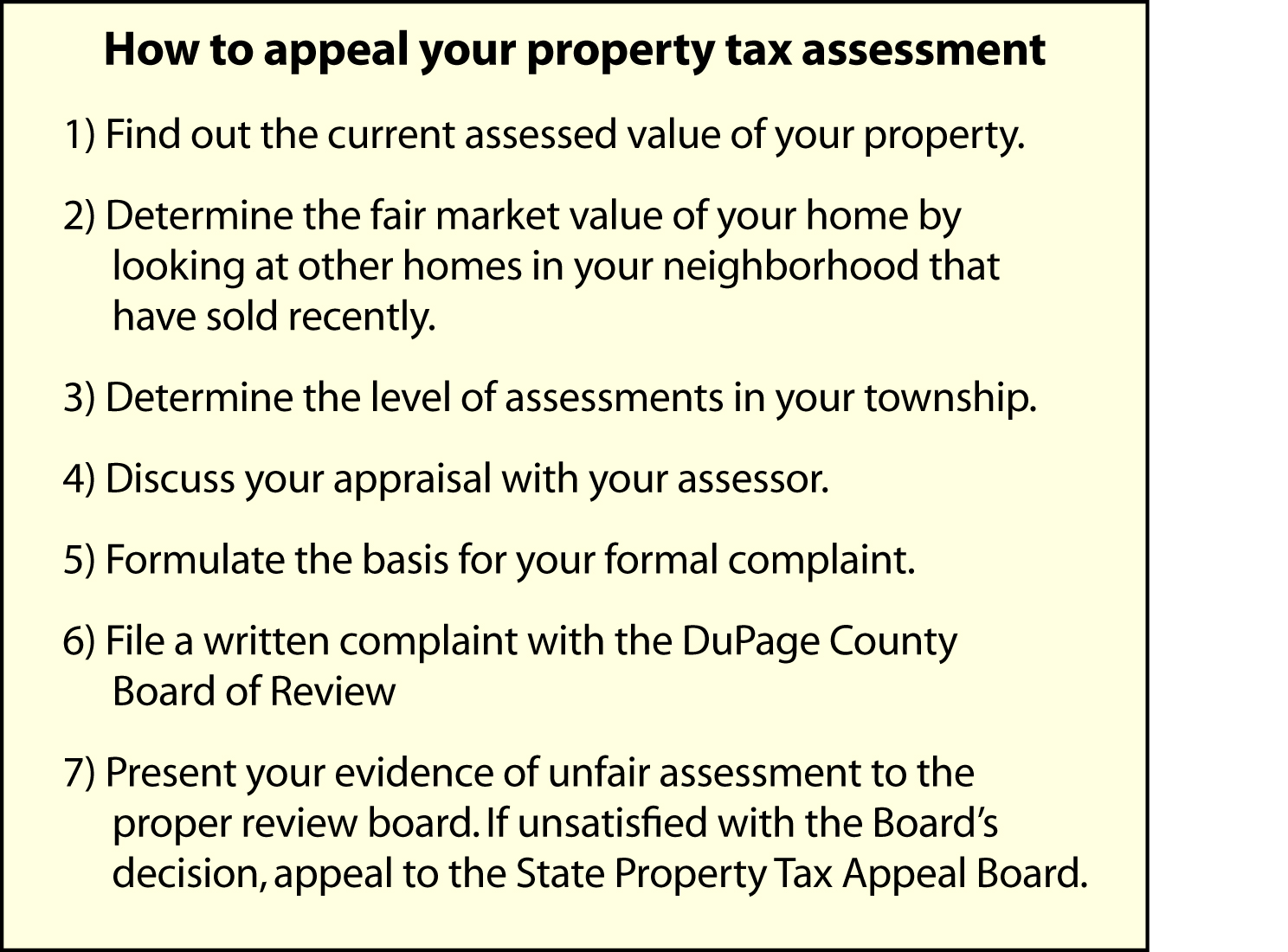

How to appeal your property taxes. Determine whether an appeal is. Your local tax collector's office sends you your property tax bill, which is based on this assessment. To use the worksheet, a property owner should:

As in filing a local property tax appeal, pay close attention to the deadline dates, and make sure you file your. Apply for tax forgiveness and get help through the process Steps for appealing property taxes.

10%) = $10,000 (assessed value) $10,000 (assessed value) x.0325 (county. Check to see if your township is open for appeals. Property tax advises and assists county revenue officials, county commissioners, and boards of equalization with administering property taxes.

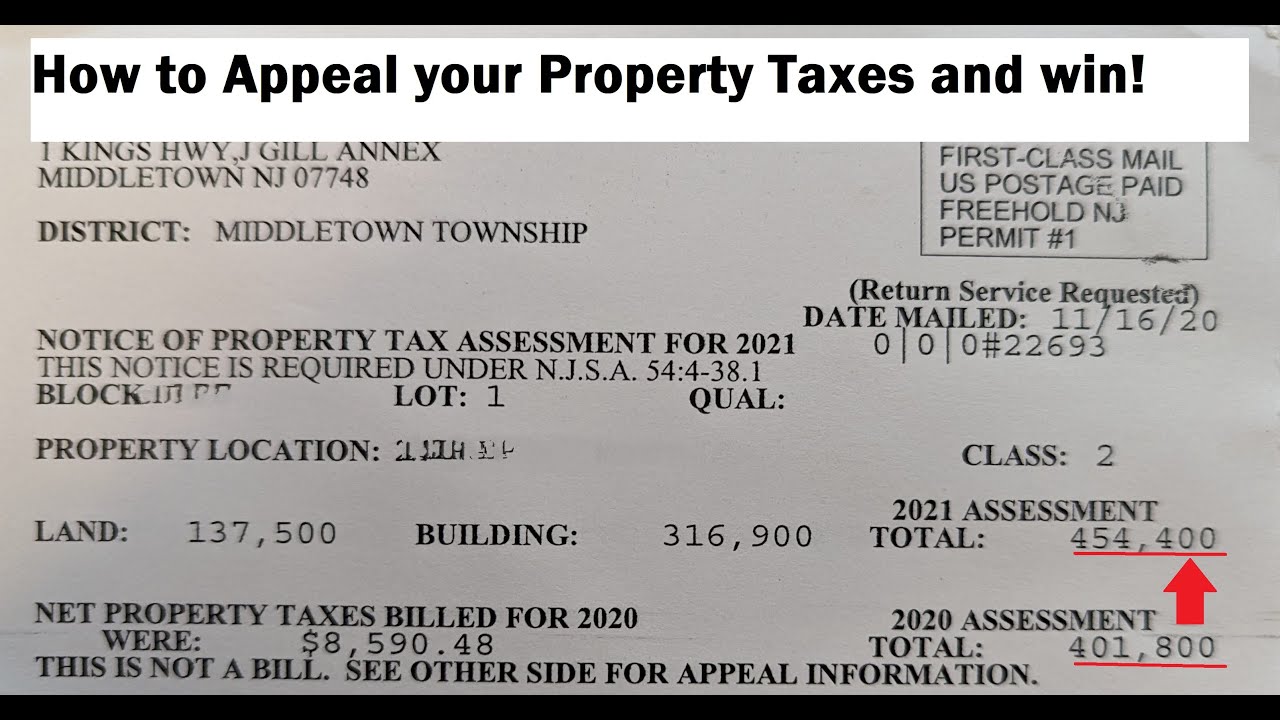

Property tax appeal procedures vary from jurisdiction to jurisdiction. In order to come up with your tax bill, your tax office multiplies the tax rate by. Carefully review your property tax bill.

Assessed value x millage rate = unadjusted tax bill. “the first would be to hire an attorney who specializes in property tax appeals to try and escalate it further, he said.the second option might be to make sure your rationale for. Your local county assessor’s office will likely have applicable fees listed on its.

23 hours agoproperty tax assessments determine the property value, which is performed by a government assessor who then uses this assessment to calculate the amount of taxes due. But that doesn’t mean you can’t appeal your assessment if you think it’s too high. Your chance of an irs audit may not be that high.