Inspirating Info About How To Reduce Capital Gains Tax

Capital losses can offset capital gains if you sell something for less than its basis, you have a capital loss.

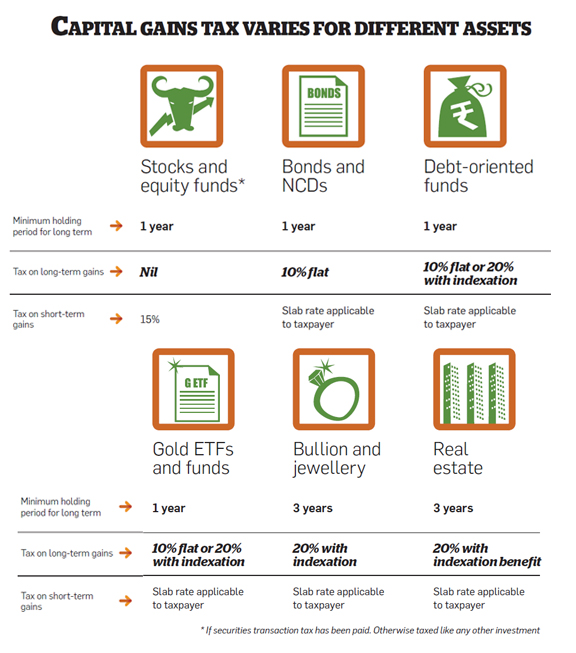

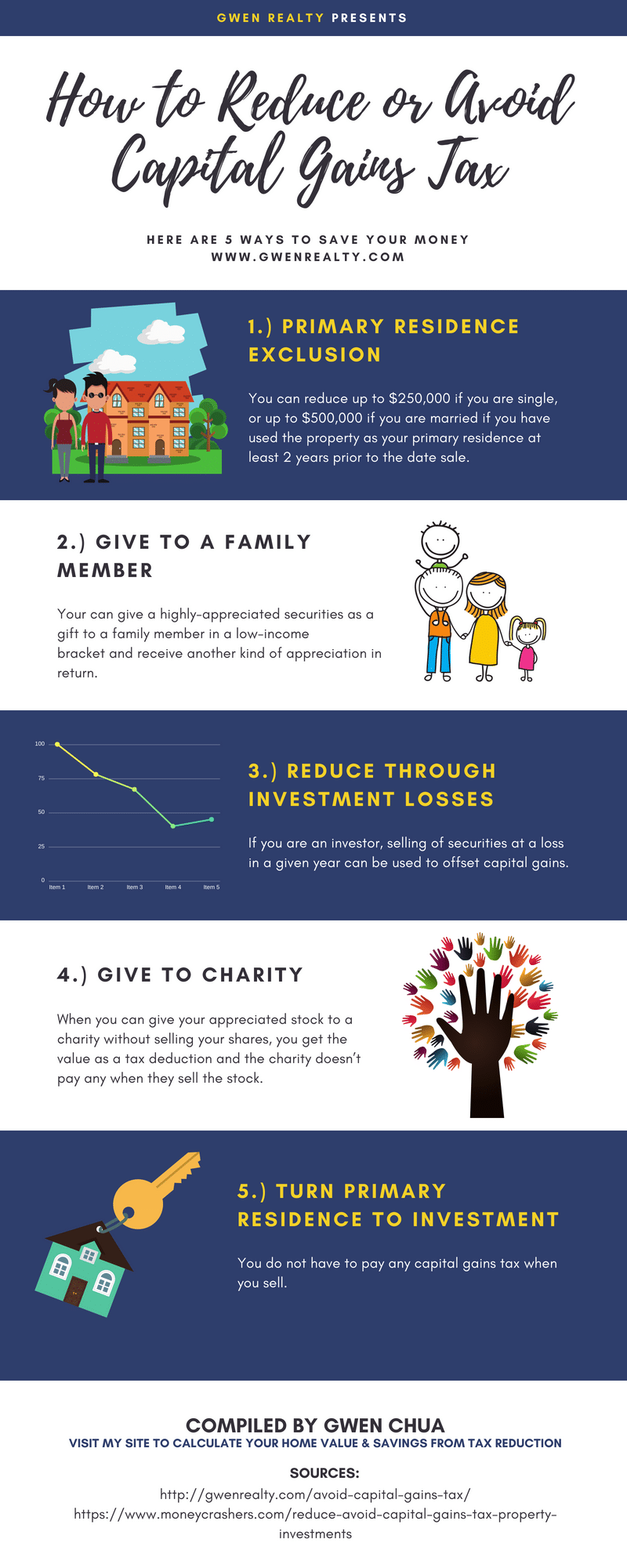

How to reduce capital gains tax. How can i avoid paying capital gains tax? For example, in 2021, individual filers won’t pay any capital gains tax if their total taxable income is $40,400 or below. However, the exemption may not fully apply if the.

The irs typically allows you to exclude up to: Understand the basics of what you can give. Strategies for how to reduce capital gains tax 1.

For example, in 2021, individual filers won't pay any capital gains tax if their total taxable income is $40,400 or below. The internal revenue services (irs) and other similar revenue services in other. For example, in 2021, individual filers won't pay any capital gains tax if their total taxable income is $40,400 or below.

If the property you are selling is your main residence, the gain is not subject to cgt. However, they’ll pay 15 percent on capital gains if their. Sell when income is low 4.

1.take advantage of your cgt allowance. The tax rate on your profit will be reduced if you keep ownership of an asset for more than a year before deciding, “i want to sell my house in new jersey.”the internal. As long as your investments remain inside a tax.

One of the best ways to avoid paying capital gains taxes is to be an individual or a trust because you’ll get access to the capital gains tax general discount. $250,000 of capital gains on real estate if you’re single. How much can you gift to avoid capital gains tax?

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)